F ixed costs are a parallel concept to variable costs in corporate finance and business management. Understanding fixed costs allows companies to better forecast their expenses, set prices, and make informed budgeting decisions.

| Key Takeaways | Summary |

| Definition | Fixed costs are expenses that do not change with increases or decreases in production or sales volumes. They remain constant within the limits of business capacity. |

| Examples | Rent, permanent staff salaries, insurance, interest, depreciation. |

| Comparison to Variable Costs | Variable costs fluctuate with production/sales volume. Fixed costs provide operating leverage – profits change disproportionately with revenue changes. |

| Calculation | Analyze profit and loss statement to identify costs that remain constant month-to-month or year-to-year. |

| Uses in Finance | Budgeting, break-even analysis, cost control, pricing decisions, evaluating operating leverage. |

Investment Banking Fundamentals

Fixed costs are expenses that do not change with increases or decreases in a company’s production or sales volumes. They remain constant, within capacity limits of a business.

Fixed costs may be direct operating costs (directly involved in the manufacturing / sales process), indirect or financial.

Examples of common fixed costs include:

The ‘fixed’ aspect doesn’t mean they never change or cannot be managed. Rather, a fixed cost is a cost that cannot easily be reduced in the short-term, and will continue to exist even when no goods or services are being produced.

If a business suffers from a decline in business and thinks this will continue, staff can be sacked, rent agreements terminated, surplus office space sold off or sub-let. None of these are simple solution though, and the costs are not a direct function of sales / production volume.

By way of comparison, variable costs are expenses that do fluctuate in proportion to production and sales volume. Examples include raw materials, hourly wages (staff on shifts), utilities (energy, water) and sales commissions. In contrast to fixed costs, variable costs can be reduced immediately by lowering production levels. Understanding the differences between fixed and variable costs is crucial for budgeting, pricing decisions, and measuring operating leverage. Companies rely heavily on fixed costs for scaling and growth, but excessive fixed costs can also make a company vulnerable in times of low sales.

Semi-variable costs, or mixed costs, have both fixed and variable components. A common example is a mobile phone bill which might have a fixed monthly charge plus additional costs based on usage. This understanding of semi-variable costs provides a more informed perspective on expense management and financial planning.

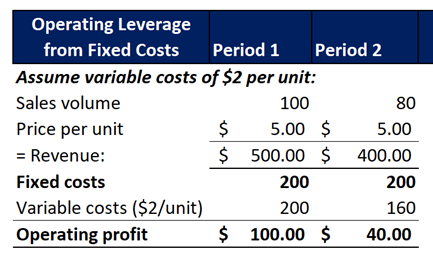

Due to fixed costs being inflexible, at least in the short term, they introduce operating risk (leverage). Take a look at these numbers to see the impact:

Note that from Period 1 to Period 2 the sales volume falls by 20% from 100 to 80 units. With fixed costs at $200 and Variables costs at $2 per unit, Profit falls by 60% . That’s leverage!

Of course, with an uptick in business of 20%, the opposite applies and profits would rise by 60%. Risk is a two-way street! In the absence of any fixed costs, the profit would fall and rise in line with Sales Revenues.

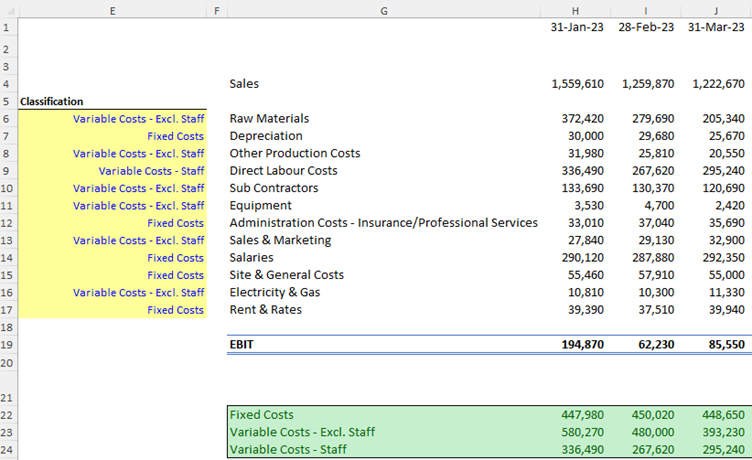

There is no single method for analysing fixed costs in Excel. When performing detailed financial analysis, we would recommend going through the profit and loss statement by category to identify items that, by name or nature, seem to remain constant from month-to-month, quarter-to-quarter or year-to-year.

Here’s a snapshot of a model Capital City Training uses in its budgeting & forecasting training:

In this example:

Classifying a cost as variable or fixed is not always a straightforward, for example:

Different industries can have varied structures of fixed and variable costs:

These industry nuances inform strategic financial management and operational decision-making processes for business decision-makers – and how you structure your models as a financial analyst.

Several key insights can be drawn from analysis of fixed costs:

Let’s look at some specific exercises and examples for analysing fixed costs:

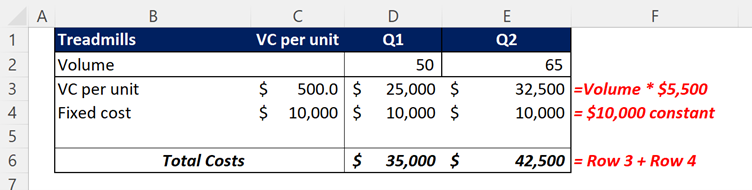

A manufacturer of treadmills produces at a variable cost per unit of $500 with fixed costs of $10,000 per quarter. In Q1 they produced 50 treadmills, and in Q2 they produced 65.

What are the total variable and fixed costs each quarter? Why does this information help?

Solution:

This information will help management with forecasting and budgeting costs and setting price levels to achieve required profit margins.

A factory operator has the following costs last month. The finance manager wants to categorise them to enable accurate budgeting. What are the categories: variable, fixed or semi-variable?

Categorise each cost as fixed or variable, or semi-variable.

Solution:

This information will assist in forecasting and budgeting. The finance manager needs to flag up which costs will rise as sales activity increases.

Take the same information from Example 1 above – the manufacturer of treadmills producing at a variable cost per unit of $500 with fixed costs of $10,000 per quarter. Assume they sell at $750 per treadmill.

How many treadmills do they have to produce and sell to cover their fixed costs? This is called the breakeven volume.

Solution:

Firstly, note the idea of ‘contribution’ to profit. This is the idea that every unit bought and sold adds Revenue and (variable) costs to the P&L.

Contribution per unit = $750 revenue – $500 variable cost = $250

Break even volume is $10,000 / £250 = 40 treadmills. Anything less than 40 units sold, the manufacturer will not cover Fixed Costs and will make an operating loss.

Grasping the fundamentals of cost-classification is an essential part of analysis, budgeting and forecasting and making informed business decisions.